Students not informed about financial matters

February 4, 2022

It’s a normal morning as you walk into school, the cold slowly fading as you walk further into the halls still a bit sleepy after waking up. There are many conversations in multiple friend groups about how the student body rarely talks about very important life topics that need to be known in order to do things like buy a house and save money. But for a collective number of high school students, it can be easy to let future problems hit the back burner in order to deal with mandatory classes in order to graduate while forgetting how important it can be to learn about how to work with money.

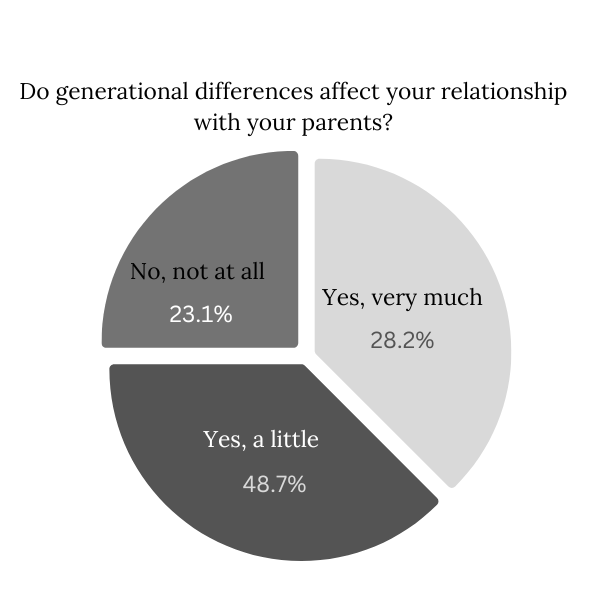

Of the many monetary issues that students must deal with, inflation directly affects students the most even if they don’t know or pay for their own food, clothes, entertainment, etc. While 66% of students believe that inflation affects them, a large number do not understand why it affects them or they don’t know what inflation is. This also stands for the 34% of students who believed that inflation does not affect them.

“When I grew up, in order to get a candy bar at the local gas station I’m trying to find nickels and quarters and collecting money and taking side jobs here and there,” economics teacher Jim Kappas said. “If all of a sudden I saw that price doubled I’d be wondering and wanting to know why.”

For those who need a quick understanding as to how inflation works, inflation is like an endless cycle of products and services becoming higher and higher priced and this can cause a lot of issues for many reasons.

Taxes will also affect some teenagers. Although conditions in order for students to file taxes are very specific, it is entirely possible that a student will need to file taxes in high school. The most common condition includes being a student worker that works 20+ hours a week at minimum wage.

“I know there’s taxes taken out of my checks,” senior Jocilyn Daguanno said.

Though it may not come as a surprise, 86% of students have no idea how to file taxes with 13% having learned from their parents and 2 students learned from either a class or teacher. Some students wonder why the school does not offer a class to teach these life skills. The first, and very important step, includes being sure that enough students would take the class as creating a new curriculum for a class is time consuming and costs a pretty penny.

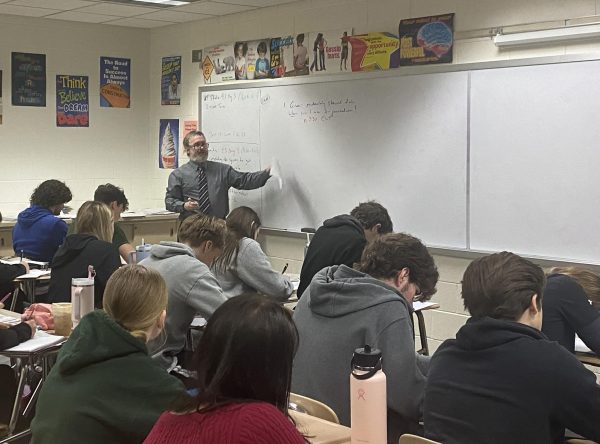

“You would need to get a teacher to put a curriculum together and then they have to get that court approved,” John Smith, government teacher, said. “The legwork of getting the curriculum put together, coming up with the class, the purpose of the class, the curriculum of the class, and then getting it approved is a long process.”

Although students say they want a class where they could learn how to do taxes and how inflation works, there is always a possibility that students once the class is offered will decide not to take it.

“I’m a Freshman in high school and I got another couple years to relax, enjoy school, and then after that head to college,” Edgar Jaquez, freshman, said.

In the end, the topic of creating a new class in order to teach students how to do things like save money, take out a loan, and file taxes is complicated. From what the student body can see, there may not be any plans to create such a class, but it is a possibility if students show a large interest in taking the hypothetical class.

In the meantime, other resources may be helpful like IRS.gov/freefile which helps with filing taxes while being entirely online. As well as making the process virtual, it can also find incorrect or missing information and inform the user to fix it. Another go to site would be usa.gov, there is a search bar in order to find exactly what the user is looking for and has step by step instructions for things like filing tax returns.